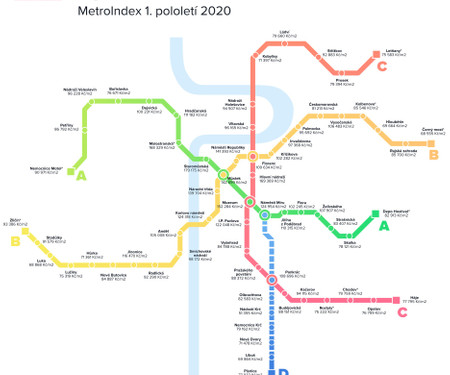

House prices are rising and mortgages are getting more expensive. Yet, the desire of young people to own a private home is not yet diminishing.

We don't know the future of interest rates and all forecasts will remain just a hope, so we will choose the more optimistic ones.

According to the CNB's estimate, it is likely that the Bank Board of the Czech National Bank will raise its interest rates before the summer recess; these would be the highest since 1999, when the average interest rate on mortgage loans was above 10%. Currently, the CNB is considering raising interest rates above the 6-6.5% level. However, this level may not be final.

Approaching the 10% mark cannot be ruled out, probably at the end of this year or at the beginning of next year - this is what Lukáš Kovanda, chief economist at Trinity Bank, predicts. That is why he recommends waiting to apply for a mortgage loan. In his opinion, first mortgages will become up to 10% more expensive. After that, however, a gradual reduction in interest rates to around 2% is to be expected. This forecast is based on forecasts for the US and German bond markets for the years 2027 to 2032.

Is it worth waiting to apply for a mortgage? Unless the applicant loses his optimism and if his life situation allows it, it certainly is. Unfortunately, this situation will cause a decline in the number of people willing and able to invest in housing under these conditions.

How to proceed in this difficult situation?

- Think through all the options for self-financing.

- Have the bank make you an offer. There is currently a lot of competition between banks. And it is therefore possible to negotiate individual terms.

- Make a financial reserve. For example, the 50:20:30 rule applies for building up a reserve, where 50% of income goes to necessary expenses (housing, food, transport), 20% of income is used as a financial reserve and 30% of income is for personal expenses and leisure.

If it is not possible to repay any loan already granted by the bank, the situation must be resolved as soon as possible. Inform the bank, ask for a deferment, a repayment plan, etc. There is usually hope of resolving the debt if one starts looking early.

VESSAN Holding financial advisors have sufficient information and a lot of experience in dealing with housing finance and saving investments. We remain at your disposal to discuss custom requests, please contact us.